- #Accounting software for small business with payroll how to

- #Accounting software for small business with payroll manual

- #Accounting software for small business with payroll full

- #Accounting software for small business with payroll Pc

- #Accounting software for small business with payroll plus

Paychex is a complete payroll and human resources platform for small and large businesses. OnPay promises no hidden fees to get started, the ability to transfer existing payroll data, and the opportunity to process payroll across multiple states and locales.

#Accounting software for small business with payroll plus

The pricing structure is easy to understand and begins at a base rate of $36/month, plus $4 per person each month. These characteristics make OnPay a smart and flexible option for small businesses that are just getting started.Īdditionally, OnPay is a budget-friendly choice for new and growing businesses. Small business owners prefer the user-friendly features, error-free guarantee, and mobile compatibility.

#Accounting software for small business with payroll Pc

OnPay is a highly rated payroll software choice that was honored with an Editor's Choice award from PC Mag. For this reason, Gusto is the perfect option for transferring or updating an existing payroll system.

#Accounting software for small business with payroll full

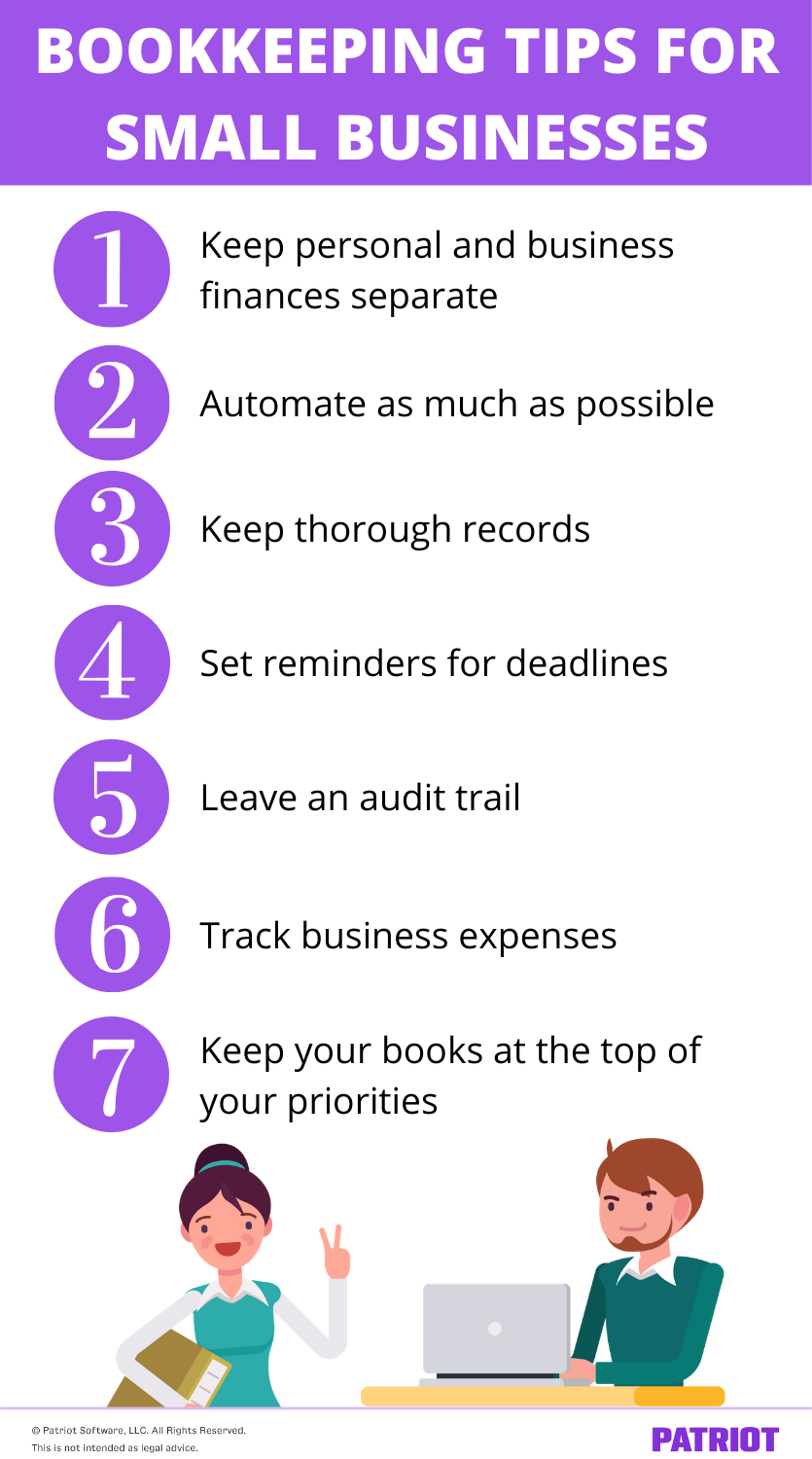

If you're new to full service payroll, choosing a system with built-in reminders and functionality shortens the learning curve and places priority on the tasks and activities that matter most.

#Accounting software for small business with payroll how to

If you're unsure how to select the best payroll software for your particular needs, we've narrowed down the options to five top picks.

There are several powerful, effective, and intuitive payroll platforms on the market.

#Accounting software for small business with payroll manual

Instead of relying on manual data entry and processing, payroll software:

An outdated payroll method tends to drain administrative resources and can contribute to unnecessary or costly payroll errors. Manual payroll services can also be time consuming and burdensome. Payroll software replaces processes that often involve data entry, time cards, paper checks, and manual bookkeeping. More Payroll Resources for Small Businesses What Does Payroll Software Do?īefore you pursue the best payroll software, you should first have a thorough understanding of what these services are capable of. How Can Payroll Transform Your Small Business? Qualities to Look for in Payroll Software We'll also share five payroll software recommendations to help you get started. In this guide, learn how full service payroll software can transform your business workflow.

Fortunately, automated payroll software options can alleviate some of the stress, confusion, and time commitment involved in the traditional payroll process. In particular, payroll is one area that businesses must prioritize to keep operations running smoothly. Back office obligations include human resources, accounting, payroll, and other critical areas that affect employees and staff members.

0 kommentar(er)

0 kommentar(er)